European Health & Fitness Market Report 2018 - EHFMR-E-BOOK

The main findings can be summarized as follows:

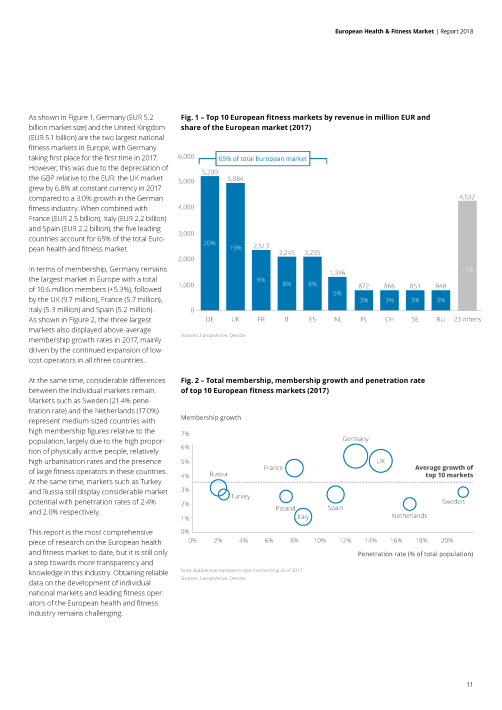

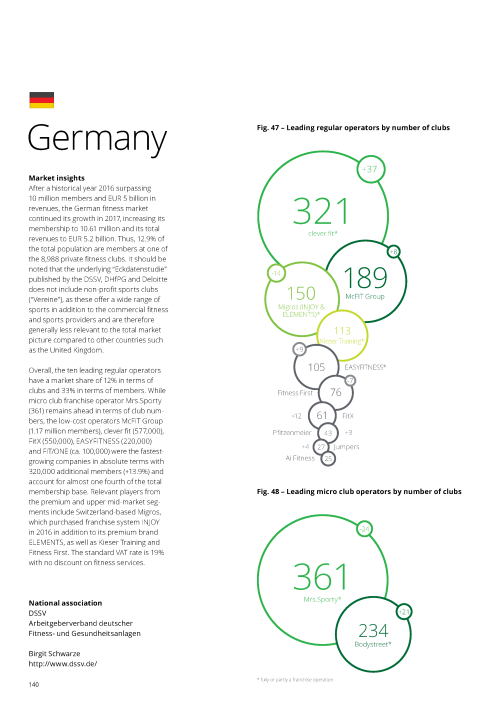

the number of members in European health and fitness clubs increased by 3.9% to 59.7 million; 7.5% of the 794 million people living in the European Union, Norway, Russia, Switzerland, Turkey and Ukraine, were members of a health or fitness club, with a penetration rate of 9.0% for people aged 15 years and older; total revenues amounted to EUR 26.5 billion in 2017, an increase of 3.7% at constant currency; the number of clubs grew by 3.3% to 59,061; the top 30 operators increased their accumulated membership by 9.8% to 14.1 million, which accounts for 23.6% of the total European membership (+1.1 percentage points); five low-cost operators (McFIT Group, Basic-Fit, Pure Gym, Fitness World and clever fit) rank among the top 10 companies in terms of revenue and seven – including The Gym Group and FitX – among the top 10 in membership; driven by the acquisition of 14 clubs from Virgin Active, David Lloyd Leisure took over as the leading European fitness club operator in terms of revenues with EUR 483 million; the leading equipment manufacturers selected for this report saw their revenues grow by 2.9% to EUR 3.0 billion, including approximately EUR 0.7 billion in the European commercial equipment market; there were 20 M&A transactions on the operator side and further deals in the equipment industry, an indication that investors regard fitness as an attractive sector to invest in.